pSOQ ↔ SOQ Bridge

Connecting Solana liquidity to post-quantum security. 1:1 exchange rate, transparent backing, and foundation subordination.

How The Bridge Works

Lock-and-mint mechanism powered by Wormhole oracles

Solana

Soqucoin L1

SOQ → pSOQ: Lock SOQ in Dilithium-secured

vault → Wormhole attests → pSOQ minted on Solana

pSOQ → SOQ: Burn pSOQ on Solana → Wormhole

observes → SOQ released from vault

Bridge Economics

Transparent backing model with market-driven convergence

pSOQ Distribution

Total pSOQ supply is fixed at 1 billion tokens on Solana.

| Holder | Amount | Status |

|---|---|---|

| Public Float | 820M (82%) | Senior |

| LP (Foundation) | 120M (12%) | Locked → Jun '26 |

| Team Wallets | 60M (6%) | Subordinated |

Expected Convergence

Vault filling timeline (conservative → bullish):

| Timeframe | Conservative | Bullish |

|---|---|---|

| Bridge Launch | 22% | 22% |

| Month 1 | 46% | 65% |

| Month 3 | 70% | 90% |

| Month 6 | 97% | 100% |

Fee Structure

Bridge fees sustain validator operations:

| Parameter | Value |

|---|---|

| Bridge Fee | 0.1% |

| Minimum Fee | 100 SOQ |

| Validator Share | 80% |

| Treasury Share | 20% |

Security Model

Multi-layered protection for bridge assets:

| Component | Protection |

|---|---|

| SOQ Vault | Dilithium (PQ-safe) |

| Oracle | Wormhole (19 validators) |

| Threshold | 5-of-7 multisig |

| Audit | Required before launch |

Discounted Entry

pSOQ currently trades below SOQ fundamental value due to bridge uncertainty:

| Scenario | Implication |

|---|---|

| pSOQ at discount | Buy cheap → redeem 1:1 at bridge |

| Bridge activates | Price converges to SOQ parity |

| Arbitrage window | Early buyers capture spread |

Solana Liquidity Advantage

Why pSOQ access matters for early positioning:

| Benefit | Details |

|---|---|

| Instant trading | Solana DEX liquidity (no mining req) |

| DeFi composability | Use in Solana protocols now |

| Pre-mainnet access | Accumulate before exchanges list SOQ |

| Portfolio diversification | PQ exposure without mining setup |

Foundation Subordination

The foundation's 180M pSOQ (18% of supply) is subordinated to public holdings. This means our tokens are worth nothing until YOUR pSOQ is fully backed.

| Priority | Holder | Amount | Redemption Rights |

|---|---|---|---|

| 1st (Senior) | Public Holders | 820M pSOQ | Can redeem immediately from vault |

| 2nd (Junior) | Foundation | 180M pSOQ | Can only redeem after vault ≥ 1B SOQ |

Bridge Timeline

Phased rollout with audit requirement before activation

Design Complete ✓

Architecture finalized, expert recommendations documented, community feedback incorporated.

Mainnet Genesis

Soqucoin L1 launches. SOQ mining begins. Bridge development starts in parallel.

Wormhole Integration

Vault contract development, Wormhole integration, and validator onboarding.

Bridge Audit

Third-party security audit (Halborn Phase 2). No activation without passing audit.

Bridge Activation

Bridge goes live after 5B SOQ mined (~block 100,000). Foundation locks 180M SOQ.

Got Questions?

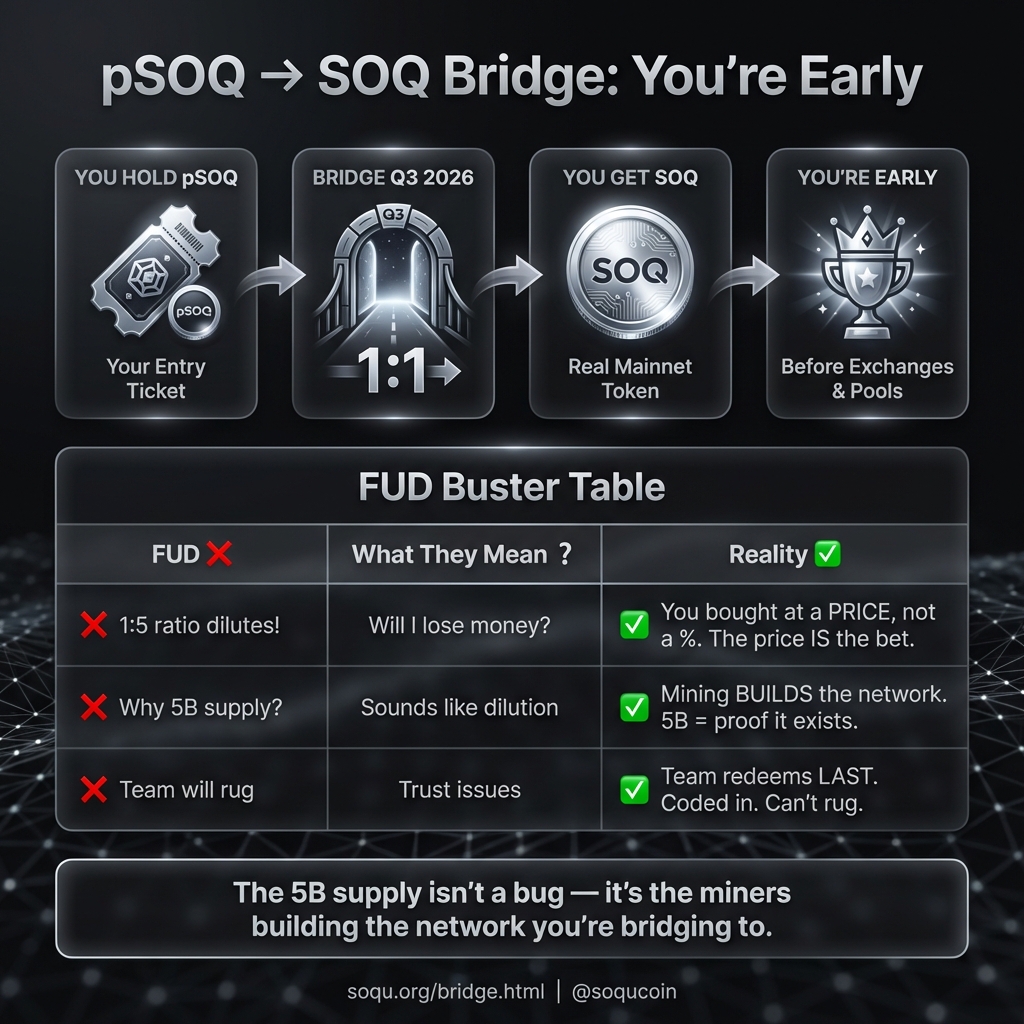

Confused about the 1:5 ratio? Worried about dilution? Wondering why we're launching at 5B supply? We've answered every common FUD in plain language.

Frequently Asked Questions

What 1:1 means:

• 1 pSOQ = 1 SOQ redemption ticket from a fixed vault

• pSOQ is NOT a percentage of SOQ supply

• pSOQ is a claim ticket on locked SOQ in the vault

Why SOQ inflation HELPS pSOQ:

• Mining creates new SOQ that gets deposited into the vault

• More SOQ mined = more backing for pSOQ holders

• Vault starts at 22% → grows toward 100% as mining fills it

• This is the opposite of dilution — it's vault growth

Simple analogy:

Think of pSOQ like a coat check ticket. You're not buying a percentage of all coats — you're buying a ticket that redeems for YOUR coat. The nightclub expanding (SOQ emission) doesn't affect whether your specific coat is in the vault.

Bottom line: pSOQ supply is fixed at 1B. As the SOQ vault fills, your pSOQ becomes fully backed. At 100% backing, 1 pSOQ = 1 SOQ, and price converges.

Initial backing (22%):

The Foundation locks 180M mined SOQ in the vault at bridge activation. This immediately backs ~22% of public pSOQ.

Ongoing growth:

The Foundation dedicates its mining infrastructure to vault filling. Every SOQ we mine goes into the vault until pSOQ is fully backed.

Organic expansion:

As the network matures, bridge fees and market dynamics contribute to vault growth. But we're not waiting for others — we're funding it ourselves.

Bottom line: You're not hoping random miners help you. The Foundation is committed to filling the vault with our own resources.

If the vault is temporarily empty:

• Your redemption enters a queue

• Mining continues daily → vault refills

• Your request processes at full 1:1 when capacity returns

You never get 0.22 SOQ per pSOQ. It's always 1:1 — you just may wait if demand spikes. The queue is temporary; mining is continuous.

1. Discounted entry — pSOQ trades below future SOQ parity due to bridge uncertainty

2. Early positioning — Accumulate before CEX listings and broader market awareness

3. Arbitrage opportunity — If bridge activates, discount closes → price converges to SOQ

4. Solana liquidity — Trade instantly on DEXs without mining setup

⚠️ Don't buy if: You can't afford to lose 100% of your investment. pSOQ is high-risk speculation. The bridge is not guaranteed. Only invest what you can lose entirely.

• pSOQ discount closes — If trading at 30% discount, bridge activation = 43% gain just from convergence

• SOQ appreciates — Post-quantum narrative + Doge-like tokenomics + mining demand could drive SOQ price

• Combined effect — Discount closing + underlying appreciation = leveraged upside without leverage

• Foundation subordination — Your redemption priority means less sell pressure from insiders

Example: If pSOQ trades at $0.00001 (30% discount to SOQ at $0.000014), bridge activation alone could mean 1.4x. If SOQ then 10x from mainnet adoption, pSOQ holders capture both moves.

• Bridge may not activate — Security audit could fail, technical issues could delay indefinitely

• SOQ may not appreciate — Post-quantum narrative may not catch on, competition could erode value

• Solana risk — pSOQ inherits Solana's security model (not post-quantum)

• Liquidity risk — Low liquidity means high slippage on large trades

• Regulatory risk — Bridge tokens face evolving regulatory scrutiny

Only invest what you can afford to lose completely.

Stay Informed

Follow our progress and join the conversation. Every decision is documented publicly.