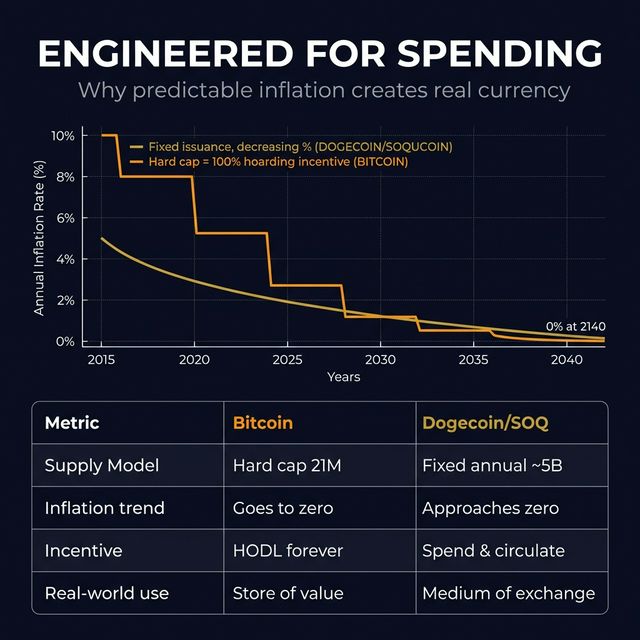

Engineered for Spending, Not Hoarding

Bitcoin's zero inflation means everyone HODLs forever — that's why it never became everyday money. Soqucoin uses Dogecoin's proven tokenomics: fixed annual issuance that shrinks as a percentage over time. This isn't a bug. It's the architecture of real currency.

Fixed issuance creates predictable, decreasing inflation — the same model used by Dogecoin ($60B market cap), Ethereum, Polkadot, Solana, and Monero.

Why Fixed Issuance Works

The #1 reason Bitcoin never became everyday money: zero inflation means everyone HODLs forever. No one spends an asset that's designed to be scarcer tomorrow. That's great for a store of value — terrible for a currency.

Dogecoin's creator Billy Markus understood this. He designed a fixed annual issuance (~5 billion DOGE/year) that creates mild, predictable inflation decreasing as a percentage over time. Currently ~3-4%, heading toward <1% long-term. The community has deliberately kept this model for 11+ years because it works.

"btw if you want to remove the inflation of dogecoin, the code is in

dogecoin/dogecoin.cpp line 146, return 10000 * COIN;

— you can change it right there, make a pull request, convince the community and miners to use

the new version. Now stop bothering me about it."

— Billy Markus (@BillyM2k / Shibetoshi Nakamoto), November 13, 2024

Elon Musk replied within hours:

"I think the flat inflation of Dogecoin, which means decreasing percentage inflation, is a feature, not a bug. Doge appears to be inflationary, but is not meaningfully so (fixed # of coins per unit time), whereas BTC is arguably deflationary to a fault."

— Elon Musk (@elonmusk), November 2024

Soqucoin = This Model + Post-Quantum Security + Lightning L2

SOQ inherits Dogecoin Core's battle-tested emission schedule, adds NIST-standardized Dilithium signatures (quantum-resistant from day one), and deploys SOQ Lightning Layer 2 for instant, near-zero-fee transactions. The result: the first truly planetary currency that's engineered for spending at scale.

Who Else Uses This Model?

Soqucoin isn't pioneering an experiment — it's joining the proven consensus of the crypto industry's most successful networks.

| Blockchain | Market Cap | Supply Model | Inflation Design |

|---|---|---|---|

| Dogecoin (DOGE) | ~$60B | Fixed ~5B/year | Percentage decreases forever — proven for 11+ years |

| Ethereum (ETH) | ~$300B+ | PoS staking rewards | Dynamic issuance, net inflationary despite EIP-1559 burn |

| Polkadot (DOT) | ~$10B | ~10% annual target | Inflationary to incentivize staking and parachain security |

| Solana (SOL) | ~$80B | Decreasing rate | Started at 8%, decreases 15%/year toward 1.5% floor |

| Monero (XMR) | ~$4B | Tail emission ~0.6 XMR/block | Perpetual fixed issuance — same philosophy as DOGE/SOQ |

| Soqucoin (SOQ) | Pre-launch | DOGE-style fixed issuance | 6 halvings → perpetual tail emission + post-quantum security |

Combined market cap of chains using inflationary models: over $450 billion. Scarcity isn't the only path. In fact, the world's most used currencies — including the US Dollar — all maintain mild inflation by design.

Myths vs. Facts

❌ MYTH

"Infinite supply means the token is worthless"

✅ FACT

Dogecoin has "unlimited" supply. Market cap: $60 billion. Supply alone doesn't determine value — utility + demand + velocity do. Every fiat currency on Earth has unlimited supply. The US Dollar is the world's reserve currency. Supply ≠ value.

❌ MYTH

"Inflation dilutes my holdings"

✅ FACT

The inflation rate (percentage) decreases every year as total supply grows. At 100B total supply, 5B new coins = 5%. At 200B, it's 2.5%. At 1 trillion, it's 0.5%. This is mathematically identical to Bitcoin's halving effect — just smoother and more predictable. Meanwhile, demand from spending, Lightning L2 transactions, and exchange listings drives price far more than issuance math.

❌ MYTH

"pSOQ holders are being diluted by mining emissions"

✅ FACT

You bought pSOQ at a price, not a percentage of supply. That price already factors in future issuance — just like buying DOGE at any point in its 11-year history. The 1:1 bridge is a redemption ticket: 1 pSOQ = 1 SOQ. Period. The Foundation redeems last ("We Eat Last") — this is coded into the bridge architecture.

❌ MYTH

"Better to wait for exchange listings"

✅ FACT

Exchange listings add a listing premium — projects routinely see 200-500% price increases at CEX listing. pSOQ holders have pre-mainnet exposure at pre-listing prices. Early miners and bridge holders control the supply before exchanges add their markup. You're early. That's your alpha.

❌ MYTH

"The team could dump tokens and rug"

✅ FACT

0% premine. Zero founder tokens. No ICO. No VC allocation. 100% of SOQ is earned through Proof-of-Work mining. The Foundation's 180M pSOQ is subordinated — redeemable only after all public holders. This is verified on-chain and legally stated. View our transparency commitments →

The Velocity Argument

Money needs to move to create an economy. Economists call this the velocity of money — how often each unit changes hands. Bitcoin's deflationary design creates the opposite: every holder has a rational incentive to never spend.

Why This Matters for Mass Adoption

- ◆ Tipping & micropayments — You don't tip with an asset you expect to 10x. Mild inflation makes spending rational.

- ◆ Merchant adoption — Businesses need a stable, circulating currency, not a speculative asset their customers refuse to spend.

- ◆ SOQ Lightning L2 — Instant, near-zero-fee transactions. Combined with spending-oriented tokenomics, this is the payment layer Bitcoin can't be.

- ◆ The Fiat Parallel — The US Dollar targets ~2% inflation. The Euro, Yen, and Pound do the same. Every successful currency in human history has maintained mild inflation. Crypto is no different.

Learn More

Dive deeper into the architecture, security, and economic design behind Soqucoin.

Protocol Specification

Emission schedule, halving phases, block rewards, and consensus parameters.

→pSOQ Bridge Architecture

How the 1:1 lock-and-mint bridge works. Proof of Reserves. Foundation subordination.

→pSOQ Holder FAQ

Common questions about ratios, supply, bridge timing, and the "We Eat Last" commitment.

→Transparency Dashboard

Supply schedule, audit status, team holdings, and project commitments — all public.

→Post-Quantum Technology

NIST Dilithium, LatticeFold+, PAT batch verification — the security layer.

→SOQ Lightning L2

Instant, near-zero-fee transactions. The spending acceleration layer.

→Ready to Experience It?

Try the live testnet sandbox — create a wallet, receive free tSOQ, and make quantum-secured transactions in your browser.